As an entrepreneur, the decision of residence become very important tax-wise. Living in the wrong country can mean you'll pay 5-10 times the tax.

I was smart to move abroad to Malta when I was 19, one of the best tax havens in Europe. Thanks to that decision, I've been paying 5% in total tax for the last decade.

When you think of the tax havens made famous by celebrities and politicians, you might have an image of sunny, far-away islands and coconuts on the beach.

However, some of the world's most lucrative tax haven countries are closer than you think. In fact, by living in Cyprus I benefit from one myself.

There are many European tax havens for companies and entrepreneurs seeking to avoid a range of tax policies digging into their precious profits.

In this article, we're diving into the top 10 European tax havens, looking at how the best tax havens work and why businesses are utilizing them more and more.

Navigation

How do tax havens work?

So, what do we mean by tax haven countries? How do tax havens work for people like you and me?

A tax haven is a country that asks for minimal tax contributions, especially from foreign businesses, often without requiring them to live inside the country full time. So they can avoid the higher taxation of their home country and keep more of their profits within the business.

This is a controversial practice that varies in severity and often sparks a moral debate.

However, some people feel that by saving money on taxes businesses can contribute more to society and offer more jobs – so it is not black and white.

Tax haven criteria

In 1998, the OECD came up with the following four points to identify tax havens around the world. This makes it easier to recognize tax havens for both individuals and governments and sheds light on what to expect from a tax haven.

- No or nominal tax on relevant income

- Lack of effective exchange of information

- Lack of transparency

- No substantial activities

Some countries in the list below are not legally classed as tax havens, however, are used in the same way and commonly thought of as lucrative options for companies wanting to save tax.

Since there is no official, world-recognized definition for a tax haven, we will use the word somewhat loosely.

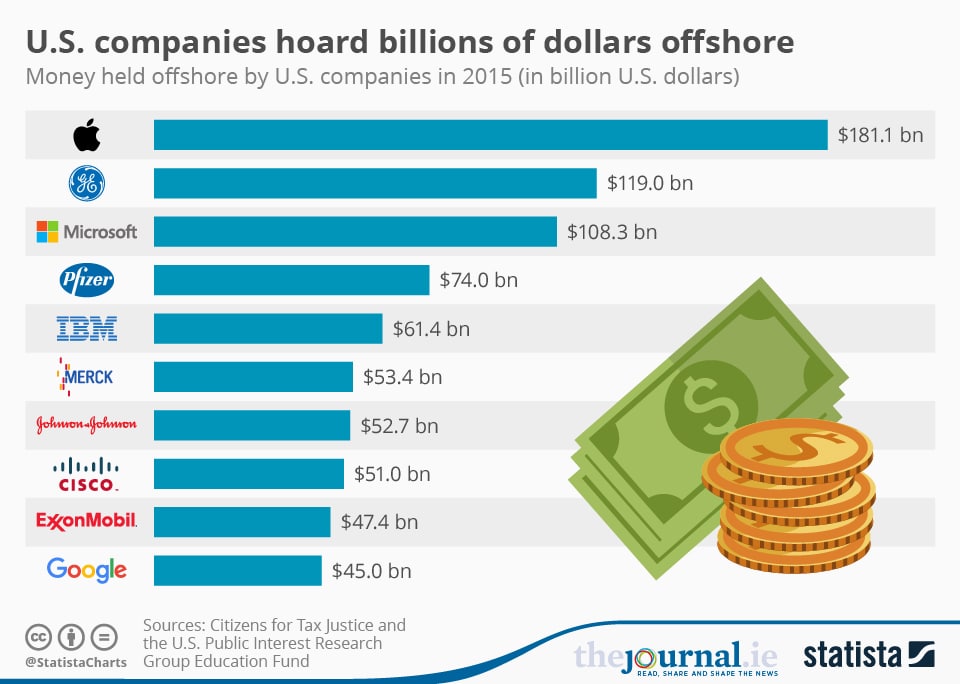

What companies use tax havens?

Many companies benefit from tax haven countries and clever accounting. Some manage to pay little to no taxes in their residing country, despite turning over billions every year.

Some notable companies using these methods include:

Nike. Nike has been known to hide their sneaker profits in offshore accounts in Bermuda.

Apple. Tech giant, Apple, has been accused of benefiting from tax havens such as Jersey and Ireland. When questioned in 2017, they refuted any wrongdoing, stating “We're proud to be the largest taxpayer in the world, as we know the important role tax payments play in society.”

Johnson and Johnson. Although disputed by Johnson and Johnson themselves, Oxfam released a global report named Prescription for Poverty in 2018, claiming that Johnson and Johnson, as well as other major pharmaceutical companies, “systematically stash their profits in overseas tax havens.”

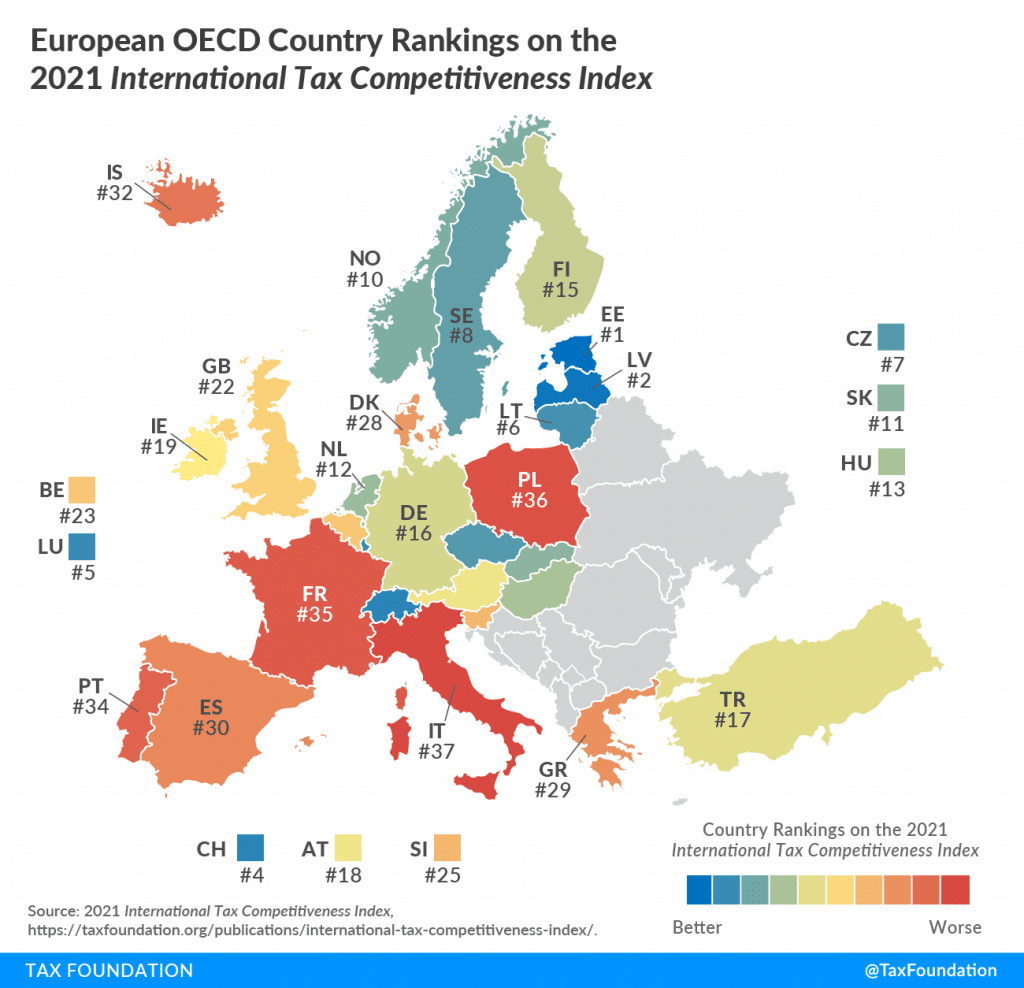

The state of taxation in Europe

Every country in Europe has the right to set its own tax rates and decide how they are spent. However, the EU does aim to avoid unfair advantages from one country to another and create fair EU-wide tax legislation.

Generally, the success of a country’s tax system is measured on two factors:

- Tax competitiveness: a tax rate that keeps marginal taxes low, attracts business, and doesn't lead to increased tax avoidance.

- Neutrality: a tax rate that raises the most revenue possible with the “fewest economic distortions,” without targeted tax breaks.

Top European tax havens

The following list includes ten of the top tax havens in Europe to date. This is not an exclusive list, nor is it in any particular order. Every company is different and so are their needs and priorities, so any of these tax havens could be the best option for you.

We are using The Corporate Tax Haven Index ‘Haven Score' 2021 results.

1. Jersey

Best for financial services

Jersey is the largest of the channel islands and has a self-governing dependency of the UK with a population of just over 100,000 people.

Jersey's lack of wealth and inheritance taxes first started to attract savvy Brits in the 1920s. Today is no different, making Jersey one of the most popular offshore destinations for U.S. dollars, rubles, yen, and other global currencies.

Tax haven score: 100/100

Pros

- No taxes for coperations doing business on the island, except for financial services, utilities, rentals, and development projects.

- No taxes on capital gains or capital transfers.

- Low personal income tax.

- No stamp duty.

Cons

- High cost of living.

- Private healthcare costs to consider(no NHS).

“Over £1 trillion of assets are held in Jersey trusts and other asset-holding vehicles, of which £400 billion are held in private trusts and roughly £600 billion in corporate asset vehicles.”

A report by Capital Economics for Jersey Finance

2. Switzerland

Best for privacy

The Tax Justice Network claims Switzerland is responsible for 5.1% of global tax avoidance losses.

Switzerland is made up of 26 different cantons, which are all allowed to set their own tax rates on top of the base level income and corporate tax set by the government, which is famously low. So, where you decide to live in Switzerland, specifically which canton, will impact how much tax you pay.

As well as an attractive tax system, foreigners look to Switzerland for their impressive and discreet banking. The Swiss Bankers’ Association states that 48% of the money in Swiss banks in 2018 was from abroad.

Tax haven score: 89/100

Pros

- Renowned for its privacy in banking and asset management.

- High standard of living.

- Low tax rates for people living in the right canton.

Cons

- A very complex tax system, making a knowledgable accountant necessary.

- High cost of living.

“The tax rate applicable to a married couple or individuals in a Swiss-registered partnership is the rate applicable to 50% of their combined income (so-called ‘splitting').”

Hans Geene, PwC Switzerland

3. Cyprus

Best for non-resident companies

Cyprus is an attractive choice for those looking for a strategic geographical location, warm climate, and very reasonable taxation laws.

While Cyprus may have lost its official tax haven status in 2019, you can still save a lot of money here in comparison to other countries.

In return for having their tax haven label removed, Cyprus agreed to increase their corporate tax to 12.5%, which is still much lower than the majority of the EU. Non-residents are exempt from taxation on income made outside of the country.

Tax haven score: 85/100

Pros

- High level of privacy.

- No tax on dividend and interest income.

- Low cost of living.

- Become a tax resident only by spending 60 days here.

Cons

- High level of bureaucracy.

“The standard VAT rate in Cyprus is 12%, yet reductions to 9% and 5% are applicable in some cases.”

Johannes Larsson, Living in Cyprus – 8 Reasons to Move Here

4. Netherlands

Best for multinational corporations

The Netherlands is the largest recipient of foreign direct investment in Europe, attracting $84 billion in 2019 alone.

They're particularly popular with large, multinational corporations with over half of the Fortune 500 companies operating a subsidiary here. High-earning individuals on the other hand pay significant taxes of up to 49.5%.

Tax haven score: 80/100

Pros

- Tax treaty with over 80 countries.

- VAT advantage for trading companies.

- Advantageous ‘30% ruling' available for some expats.

- Stable economy and impressive IT infrastructure.

Cons

- A complicated tax system for expats to understand.

“Research shows that international companies make a positive contribution to the Dutch economy and society. For example, various statistics show that foreign companies account for around 18% of the added value to our economy.”

Government of the Netherlands

5. Malta

Best for low business costs

Malta was the first tax haven I moved to after growing up in Sweden, I set up my company and lived there for quite a few years.

If you're setting up a company and want to make the most of an advantageous tax structure, you can't really go wrong with Malta, where the cost of setting up and running a business is one of the lowest in Europe.

Tax haven score: 79/100

Pros

- By using a holding company outside of Malta for your profits, you reduce your corporate tax payments to just 5-7%, some of the lowest in the EU.

- Many business expenses can be deducted pre-tax.

- Lower salaries and social security make Malta an attractive option for business owners hiring locally.

Cons

- It is time-consuming to set up a Malta Ltd company and can get complicated, so it's best to speak to somebody who has been through the process – like myself. Feel free to reach out if you have any questions.

- The Maltese tax system is not overly efficient. A lot of paperwork and delays in tax refunds is common.

“The corporate taxes in Malta is 35%, flat rate, which is highest in EU. However, you can reduce it down to an effective tax rate of 5-7% by distributing all the profits to the holding company. Usually, the holding company will be set up in Cyprus, Seychelles, or Gibraltar. “

Johannes Larsson, 10 Reasons To Relocate Yourself And Your Business To Malta

6. Ireland

Best for research and development startups

Corporate taxation in Ireland is considered one of the lowest in Europe, with their corporate tax rate at 12.5%.

However, they're particularly favorable for startups within the field of research and development, offering what is called the ‘R&D tax credit'. This gives a 25% relief on R&D expenditure, which can be used to lower a companies tax liability or even given as a cash refund.

Ireland has also come under criticism for allowing tech giant Apple to pay less than 2% in taxes on $74 billion between 2009-2012.

Tax haven score: 77/100

Pros

- Tax treaty with over 70 countries.

- Impressive tax breaks for R&D companies.

- High numbers of entrepreneurs.

Cons

- High cost of living.

“If you look at our GDP per capita we have one of the highest in the world. It looks like we are one of the richest countries, but then if you look at our health service, pupil-teacher ratios, cost of childcare, or our record on environmental measures, Ireland comes near the bottom of those lists because we have a very small public sector and the reason for that is because we are a tax haven.”

Brian O’Boyle, co-author of Tax Haven Ireland

7. Luxembourg

Best for foreign investors

In an investigation in 2021, Le Monde found that 90% of the companies registered in Luxembourg are from non-Luxembourgers, from 157 different nationalities.

This small European country with a population of around 634,700 made world news in 2014 for a financial scandal coined ‘The Luxembourg Leaks', in which it was unearthed that they were assisting corporations around the world to benefit from tax rates as low as 0.25%. Amazon, FedEx, and IKEA were amongst the companies named in the transgression.

Most taxes in Luxembourg are set at a local level, however, local business and property taxes vary from municipality to municipality.

Tax haven score: 74/100

Pros

- Non-residents only have to pay tax on their Luxembourg income.

- Lower income tax rates for married couples, whom are taxed jointly after living together for over a year.

- No capital gains tax for your first property.

Cons

- One of the most complicated tax systems in the world.

“Documents obtained by the International Consortium of Investigative Journalists revealed hundreds of multinational corporations had entered into tax agreements with Luxembourg that allowed them to pay an effective tax rate less than 1%.”

Jesse Neugarten, Investopedia

8. Estonia

Best for digital nomads and solopreneurs

Digital nomads, business owners, and investors flock to Estonia every year.

While Estonia does charge an income tax of 20%, they only tax you on what you choose to take out of your business, or investment. So if you reinvest your profits you can pay very little in tax.

The famous Estonian E-residency is a great option for non-EU citizens who want to create an EU company. It's easy and affordable to set up, and totally digital, perfect for online entrepreneurs.

They also offer two other popular visa types for online entrepreneurs, the Estonia Start-up Visa and Estonia Digital Nomad visa, making this one of the best digital nomad cities.

Tax haven score: 70/100

Pros

- E-residency gives non-EU citizens the chance to create an EU company.

- Everything is digital and easy to set up.

- You're only taxed on money you take out of the business.

- 0% tax on reinvestments.

Cons

- Double taxation treaties are only available for specific countries, so you could pay double income tax depending on your tax residency.

“Estonia became the first country in the world to use blockchain technology in public services, attempt a national ICO and have a completely digital voting election. It has sought to develop its niche as Europe's destination for all things crypto with the launch of its cryptocurrency exchange licenses which has gained much global attention.”

Offshore Protection

9. England

Best for capital gains

British territories such as the British Virgin Islands and the Cayman Islands are well known for their tax-avoiding benefits, both charging no corporate or capital gains tax.

However, England itself is considered to be a tax haven for rich foreigners from all over the globe. Setting up a trust or foundation is a popular way of legally skirting taxes.

Tax haven score: 69/100

Pros

- The UK has double-taxation agreements with more than 130 countries.

- Tax-free allowances for dividends (up to £2,000), savings interest, and the first £12,570 of income.

Cons

- Median earners can lose out as average tax rates rise quickest in comparison to income in the UK.

“Foundations and trusts are typical tax haven vehicles foreigners use to offer a protective tax-free or tax-reduced wrapper around assets. The country is particularly popular with foreign billionaires who benefit from a lack of income or capital gains taxes on investments held outside of the country.”

Melissa Parietti, Investopedia

10. Monaco

Best for wealthy business owners

Ideally situated on the French Riviera, Monaco is a tax haven particularly popular with the ultra-rich. In fact, an estimated 1/3 of the country's residents are millionaires.

As a resident of Monaco, you can avoid personal and corporate income tax and capital gains tax. However, you must spend 6 months and 1 day out of the year in the principality to be considered a resident.

Monaco is known for being discreet when it comes to their resident's financial information, so if privacy is top of your list this could be a good option for you.

Tax haven score: 67/100

Pros

- No personal income tax, corporate income tax, capital gains tax, wealth tax, or inheritance tax (for direct heirs).

- Few property taxes (just 1% tax on rental properties).

Cons

- You have to live in Monaco for at least 6 months and 1 day out of the year to benefit from their taxation policies.

- Very expensive cost of living and property prices.

“The government says you can have a business in Monaco if you live in Monaco or the surrounding area. Of course, it would be better to have Monegasque residency, but it’s not necessary. One can very well live in Nice and have a business in Monaco.”

Francesca German, Monaco Tribune

FAQ about the best tax havens in Europe

Is it legal to use a tax haven?

Using the advantageous tax laws of a country is legal, as long as you're doing everything by the book. Generally speaking, it is the country in mention's responsibility to create effective tax systems that do not break any laws, not the individuals using that system.

Always speak to an accountant and make sure you're paying taxes legally, in your home country and any other country you're required to do so.

How do tax havens work and make money?

People often wonder how do tax havens work so well for businesses without compromising the country as a whole. The best tax havens may give a financial break at their core, but that doesn't mean they get nothing in return. Tax havens can make money in the following ways:

- Registration and renewal fees for cooperations

- Departure taxes

- Import duties

- Annual license fees

When did tax havens emerge?

Founded in 1848, the Swiss Confederation is often seen as the first recognized tax haven – although many believe this was by no means the beginning.

Ancient Rome was known for using tax policies as a clever war tactic, with the first recorded incident as far back as the 2nd Century BC.

Over time the use of tax havens has developed from downright tax avoidance to a way for businesses to lower their global tax obligations.

Further reading on tax havens:

Choosing your tax haven

Tax havens are always changing and so are the ways we use them.

Whether you're a millionaire in Monaco, enjoying discreet Swiss banking, or like me, have relocated to a sunny island that makes more sense for myself personally and business wise, we all live in a globalized world with a lot of different choices and options.

Sometimes it can feel overwhelming to figure out what tax haven you should choose. A lot of research is needed, and many times, it's difficult to find clarity because different sources are stating different things.

I would recommend you to get in touch with tax accountants and set-up an introductory meeting in order to learn more.

If you need contacts for Malta or Cyprus, let me know and I'll refer you to the people I'm using.

Do you benefit from any of the best tax havens? How do you feel about them?

Leave me a comment below.

So inlighting. THanks Johannes for sharing this :)

Low tax rates and financial privacy is a huge plus for entrepreneurs. This list is a 10/10 for European tax havens.

Of the above mentioned places for entrepreneurs and digital nomads, Cyprus is my FAVORITE! The beautiful beaches, sunsets and people make for a great work-life balance as a business owner. Not to mention the favorable tax policies and strategic location it provides. The corporate tax rate and the several tax incentives available to businesses is a great location to own a business. I have been very happy here in Cyprus, however appreciate you sharing the list above as alternatives for every business owner to consider :)