I used to travel around quite a lot back in my digital nomad days. I remember spending quite a bit of time finding a good insurance for nomads, so here I'll be sharing some insights.

Interestingly enough, according to ABTA, as many as two in five British people traveled abroad in 2017 without the right travel insurance.

If recent years have shown us anything, it's that you can never be too prepared when it comes to keeping yourself safe.

If you're a digital nomad, or an entrepreneur who loves traveling around, picking the right travel insurance can be especially important for you.

In this blog post, I'm going to answer the question ‘do you need travel insurance?' and compare the best travel insurances for digital nomads, entrepreneurs and self-employed people.

Navigation

Do you need travel insurance?

Travel insurance is designed to protect you from unexpected scenarios that may arise whilst you are abroad, whether for work or pleasure.

People often ask, do you need travel insurance or is it an unnecessary cost?

In my opinion, you wouldn't be smart to travel without being properly insured as an entrepreneur or digital nomad.

Especially since you can get reasonably cheap travel insurance with high flexibility these days.

As a business owner, you have people relying on you, whether it's your customers, your team, or investors, you don't want to let them down because you tried to skimp on a small travel cost like travel insurance.

If you run into any of the following issues while you're away from home, you could end up in a financial crisis if you don't have proper cover.

Travel insurance (generally) covers:

- Medical emergencies. If you become unwell, injured or even pass away during your trip, this can avoid a huge expense for you or your loved ones.

- Personal liability. In case you cause harm to any person or property and face legal fees.

- Personal belongings/money. If your belongings are lost, damaged or stolen abroad.

- Cancelled or missed transportation. If you're unable to board your flight, for example, because of unexpected events like bereavement or illness.

- Disasters and unexpected events. If your trip is affected by terrorism, civil unrest, earthquakes, volcano eruptions or adverse weather.

The cost of travel insurance will generally depend on the country you're visiting, the provider you choose, the length of your stay, the activities you'll be partaking in, the goods you'll be traveling with, and any pre-existing medical conditions you have.

“If you don't have travel insurance you will have to pay out of your own pocket to deal with a problem while you're away. Or you may lose money if you have to cancel a trip and can't get your money back. This could cost you thousands of pounds.”

Citizens Advice

Top travel insurances for nomads & entrepreneurs

There's no such thing as “the best travel insurance”. One person has different needs from another.

We all have different businesses and lifestyles, so we need to pick an insurance that fits our needs.

I've included my top 5 travel insurance that fits entrepreneurs and digital nomads, but for different needs.

#1 Best travel insurance for digital nomads: World Nomads

World Nomads is the go-to choice for digital nomads.

If you're an entrepreneur that loves to work remotely in different countries, while enjoying the local culture and activities, this could be a good option for you.

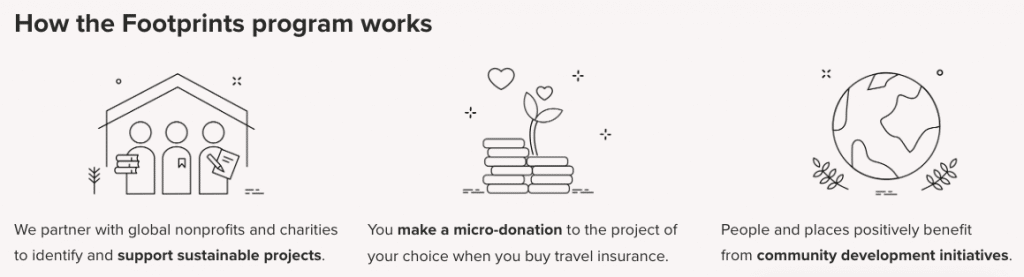

Every time you buy World Nomad travel insurance you're supporting a global non-profit or charity, so you can even feel good while you're protecting yourself.

Key points

- You can buy travel insurance while you're away. Want to extend your trip or your plans change? No problem.

- Covered for 200+ activities including skydiving, jet skiing and snowboarding.

- 24/7 emergency assistance, 365 days a year.

- Slightly more expensive than some other providers who don't have as much coverage.

“Had to file a rather large claim, [the] process was simple if you had all the right documents which we did. Did 98% of the process online which was seamless. Two weeks later we had our check.”

Review taken from Trust Pilot

#2 Best travel insurance for tech entrepreneurs: Switched On Gadget Travel Insurance

Many travel insurance policies provide little or even no gadget cover, which puts tech entrepreneurs who may be traveling with expensive laptops, phones, and mics at risk.

Switched On Insurance are travel insurance providers who also specialize in comprehensive gadget insurance, so they know how to protect your equipment.

Whether you decide to choose Switched On Insurance or another provider, make sure your travel insurance covers your gadgets, especially if you carry a lot of expensive technology.

Key points

- Gadget cover for up to £3,000 with no excess, in their Ultimate Cover package.

- Specialists in gadget insurance.

- Cover for individuals, couples and families.

“I have been with this company for about three years they are very competitively priced. All my questions and concerns have been answered in a professional and courteous manner and I have just taken out a policy on my new phone.”

Review taken from Trust pilot

#3 Best travel insurance for small business teams: Axa Health

If you want to cover yourself and the employees of your small business then Axa Health may have a plan for you.

Axa Health is trusted by thousands of small businesses and you can choose a plan that fits the travel needs of your team, both for work and pleasure.

Key points

- Cover for your employees and their family members aged up to 88.

- 24-hour international emergency medical assistance and travel information helpline.

- Worldwide and European cover available.

- Generous policy regarding pre-existing conditions.

“I've had to make a couple of claims on my AXA travel insurance and they've always been straightforward and reasonable to deal with.”

Review taken from Trust Pilot

#4 Best travel insurance for entrepreneurs on a budget: InsureMyTrip

If you're on a budget then it's essential to compare cheap travel insurance options to get the best deal, but as a busy entrepreneur that isn't always possible.

That's why I've chosen InsureMyTrip, a popular travel insurance comparison site for my budget choice.

You just have to enter your details into one quick comparison tool and they'll give you a whole range of options to choose from, so you know you're getting the best deal.

Key points

- Easily view and compare multiple plans for your trip to find cheap travel insurance that fits your needs.

- You can customise plans and choose what you do and don't need so that you don't pay for anything you don't require.

- Not all travel providers are included in their listings.

- Twenty years of insuring travellers.

“I have happily used Insuremytrip.com several times in the past, but this time felt the need to call them. Wow! Kathy really took the time to find out what I wanted/needed and explained all the different choices to me. It was easy to understand – even the pre-existing conditions clauses! Friendly, pleasant, helpful – what more could I ask for?”

Review taken from Trust Pilot

#5 Best credit card travel insurance: Vitality American Express® Credit Card

People often ask what is the best travel insurance included in a credit card. The simple answer is, no credit card gives free, all-inclusive travel insurance without a hefty fee.

Purchasing an item on your credit card usually makes it easier for you to get a refund. This can be confused with travel insurance as it can protect you against some similar circumstances such as the airline going bust or holiday being canceled.

There are many things credit cards cannot protect you against when traveling though, such as stolen goods or illness.

Vitality American Express® Credit Card does however include travel accident insurance up to £150,000. If you have separate medical insurance, this could be a good option for those on a budget who want to make the most of the other credit card benefits American Express offers.

Key points

- No annual fee.

- Doesn't include health insurance so this would need to be bought seperately.

- Travel accident insurance up to £150,000 for public transport tickets bought with your Vitality American Express® credit card.

- Global assist provides 24/7 assistance when travelling outside of the UK.

- Generous cashback scheme.

“There’s also the regular Amex benefits, such as American Express Experiences, travel insurance and 24/7 global customer support. Otherwise, the Vitality credit card boasts a fairly competitive purchase rate of 22.2% p.a., but a representative APR of 35.9%, thanks to a £6 monthly fee.”

Review taken from Finder.com

Frequently asked questions about travel insurance

Does travel insurance cover coronavirus?

It's likely that the Coronavirus pandemic will have an impact on your travels, including your travel insurance. You will need to ask your provider directly: “does travel insurance cover coronavirus or will you be liable yourself?” in order to be sure.

Warning: Confirm that your travel insurance gives you protection to all of the following while visiting countries affected by Coronavirus.

- Governmental or local advice/restrictions changing and affecting whether you can travel.

- Getting Coronavirus symptoms while away and requiring isolation or medical care.

- Flights being cancelled and airlines going bust.

- Hotel cancelations.

Doesn't my bank already give me free travel insurance?

Some banks and credit cards do provide travel insurance, so this is definitely worth checking out. It's especially common for online banks to offer these types of extras.

However, the policies can often be limited and rarely cover your family members and extras such as medical care, activities, and gadgets.

Read the policy very carefully to decide whether or not you need to take out more cover.

How expensive is travel insurance?

This is a difficult question to answer because travel insurance comes in a wide range of prices. However, it is definitely possible to get cheap travel insurance.

Everyone gets a unique quote depending on a range of factors, such as age, destination, activities, and medical conditions.

One thing is for sure, the cost will be nothing compared to what you might end up paying if something goes wrong when you don't have it.

Will travel insurance help if the airline I booked my flight with goes bust?

If an airline collapses after you have booked your flight, it can be very difficult to receive your money back from them directly.

However, if you have valid travel insurance you should have a much easier time making a claim and with their support may be able to get back at least some if not all of your money.

Does EHIC count as travel insurance?

If you're traveling in Europe and have a valid EHIC card (less than 5 years old and in date) then you can get emergency health care in participating countries.

However, this is by no means a substitute for travel insurance so you cannot rely on it alone. Not only is it not full medical insurance, but it also won't protect any of your belongings or other issues you could run into on your trip.

What about health insurance for self-employed people?

Whether you have travel planned or not, it's important to think about health insurance for self-employed entrepreneurs.

If you're living in a country with a free healthcare system, this might not be necesary for you. Although you may want to consider getting insurance to cover extras such as dental or mental health care.

When you're self-employed you don't have an employer taking responsability for your health insurance needs, so you need to make these decisions yourself.

You can start by deciding if it makes more sense for you to pay for your health insurance privately, or if you can, put it through as a business cost. Just be sure to check the rules for your country and make a decision which is both fiancially smart, but will give you that peace of mind you need so that you can focus on your business without unecesarry worries.

Final words

Travel insurance is probably not at the top of your ever-growing to-do list as an entrepreneur.

Sometimes business calls and last-minute trips are required, but I urge you to always make time to book your travel insurance.

It's so quick and easy to do these days. You could save yourself thousands and a huge amount of heartache by making this an essential step in your travel booking process.

Whatever your entrepreneurial needs, whether you need cheap travel insurance, one that protects your gadgets, your employees or allows you to go scuba diving in between meetings, I hope you found this article helpful.

What is your recommended travel insurance as an entrepreneur?

Let me know in the comments!

Top info in this articvle. Thanks for the walualbe info on travel insurance for digital nomads.

One of the things I appreciated most about this post was the level of detail provided about each insurance provider. Johannes explains the various features and benefits of each plan, as well as any limitations or exclusions. This level of transparency is essential when it comes to choosing the right insurance plan for your needs, and it shows that Johannes Larsson truly cares about helping readers make an informed decision. Thank you for this post.

Health coverage, trop cancellation/ interruption, personal liability and electronic device cover are all such important aspects to consider as a digital nomad when constantly travelling. I have been caught off-guard before in a travelling incident and paid WAY MORE than I expected for something that could have been avoided if I only had the right travel insurance. Learned from that mistake and will NEVER travel again without it.

Thank you for the honest and true information in this article. So important and a must consider for all digital nomads and travel enthusiasts.

When selecting travel insurance as a digital nomad or entrepreneur, it is important to look for a policy that provides comprehensive coverage for the specific risks that you may face while traveling for business purposes. It is also important to read the policy details carefully to ensure that the coverage meets your needs and budget. Thanks again JL for this information 10/10 100%